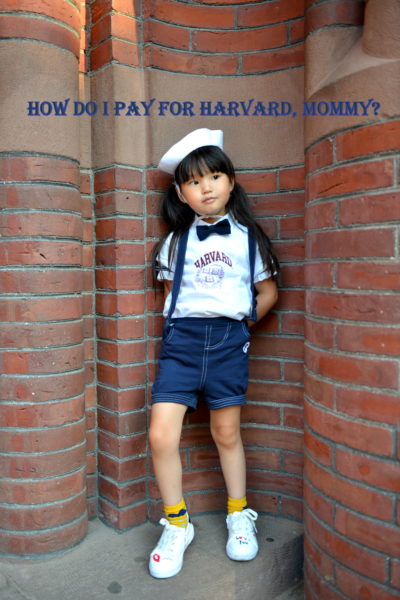

How To Pay For Harvard When It’s $137,312 Per Year

She’s only 5. why worry about college tuition now?

Harvard tuition, room, board and fees currently cost $67,580 for 2019. Yale, my other alma mater costs $70,570. (YIKES, I KNOW!!) To make matters even scarier, tuition is expected to continue to increase every year by 5%. We may have already invested 80k towards our daughter’s future college of choice but this is nowhere near the $143,387 she will need for Yale or the $137,312 for Harvard in 2031. And yes, that is only the per year cost. Take a moment to let that sink in…. (GULP!!) I’m no math wizard, I just inputted basic information into the college calculator to figure this out. Anyone else interested in the NY529 college savings plan now? Below are some frequently asked questions and answers thanks to the MomTrends event and seminar held by NY529, regarding how you can save to afford the college of your child’s choice!

(Please let it be Harvard, please let it be Harvard)

What is a 529 college savings plan?

- It’s a type of investment account you can use for higher-education savings. 529 plans are usually sponsored by states and are beneficial in the form of tax savings. (tax deductions, tax-deferred growth, and tax-free withdrawals).

Who can contribute to the plan?

- Any U.S. citizen or a resident alien can contribute! Grandparents, friends, and of course parents. Instead of traditional gifts this year, why not gift an investment instead? You can even invite friends and family to contribute to your account by sharing a special Ugift code on Twitter or by email. Ugift also provides printable gift coupons that you can distribute in person or by mail. I love this idea.

Restrictions?

- There are no income restrictions to open a 529 account. Up to $10,000 is deductible annually from New York State taxable income for married couples filing jointly or $5000 for single taxpayers. And get this! The money doesn’t have to be used just for tuition. It can be used towards paying for any higher-education expense like: books; computers, software, supplies, and certain room and board fees. That sounds great doesn’t it? It can even be applied towards:

- Out of state colleges

- Postsecondary trade and vocational schools.

- 2- and 4-year colleges and

- Postgraduate programs

For more info.on the NY 529 check my earlier post about the 5 things I didn’t know about the 529 that you should. Or see the NY 529 FAQs here.

Disclaimers:

Compensation was provided by NY 529 Direct via Momtrends. The opinions expressed herein are those of the author and are not indicative of the opinions of NY 529 Direct or Momtrends.

Investments in the plan are subject to risk. Before you invest, consider whether your or the beneficiary’s home state offers any state tax or other benefits that are only available for investments in that state’s 529 plan.

The Comptroller of the State of New York and the New York State Higher Education Services Corporation are the Program Administrators and are responsible for implementing and administering the Direct Plan. Ascensus Broker Dealer Services, Inc., serves as Program Manager and, in connection with its affiliates, provides recordkeeping and administrative support services and is responsible for day-to-day operations of the Direct Plan. The Vanguard Group, Inc., serves as the Investment Manager. Vanguard Marketing Corporation markets, distributes, and underwrites the Direct Plan.

No guarantee: None of the State of New York, its agencies, the Federal Deposit Insurance Corporation (FDIC), The Vanguard Group, Inc., Ascensus Broker Dealer Services, Inc., nor any of their applicable affiliates insures accounts or guarantees the principal deposited therein or any investment returns on any account or investment portfolio.

New York’s 529 College Savings Program currently includes two separate 529 plans. The Direct Plan is sold directly by the Program. You may also participate in the Advisor Plan, which is sold exclusively through financial advisors and has different investment options and higher fees and expenses as well as financial advisor compensation.

For more information about New York’s 529 College Savings Program Direct Plan, obtain a Disclosure Booklet and Tuition Savings Agreement at www.nysaves.org or by calling 1-877-NYSAVES. This includes investment objectives, risks, charges, expenses, and other information. You should read and consider them carefully before investing.

It’s gonna be that expen$sive? That blows my mind…

better save now…

shocking isn’t it?